Security 2017 was the perfect chance to get our heads around the latest security systems, as well as getting a feel for industry trends – a sense of where the industry is heading in the future, how far down the path of that development we really are and how fast our industry is changing.

WHAT was new at Security 2017? Plenty and across all market segments – surveillance, access control, intrusion, networking and the physical security components that support them. What stood out most? It was the acceleration of fundamental change, the ongoing process of integration and the recognition by many vendors of the lateral sprawl of technologies with the capacity to enhance multi-stranded operational outcomes that most struck me. On many stands, I heard a similar refrain: We are selling solutions to users’ problems, not products and features.

This position might seem to strike a false note but on deeper thought, it’s the right position. Selling complex security solutions is fundamentally about educating the market and as astrophysicist Neil deGrasse Tyson pointed out during a Think Inc keynote speech at the ICC the night after Security 2017, the most important aspect of education is not projecting what you know but establishing how others learn best. At the professional security level, that means discovering end users’ operational challenges then explaining how your technology can be their solution.

This was the exhibition of a mature industry – polished, well managed and strongly supported. The floor space was unquestionably the largest I’ve seen at an Aussie security show and the traffic flows were solid, especially on day 1 and for the first 2 thirds of day 2. Diversified, the organisers of Security 2017, managed the event seamlessly, though some of the credit for the slickness accrues to the design of the new purpose-built ICC building. The exhibition space, its operational functionality and much enhanced Darling Harbour precinct combined to make Security 2017 arguably the best local security event we’ve attended. Most exhibitors were happy, too.

As every visitor would have found, it’s tough to see everything at any exhibition – there are the distractions of catching up with people on every booth and the difficulties of side-stepping one’s internal biases. In my case, those biases tend towards devices rather than software. Then there’s the lack of time to spend getting a summary of every new product on display – some bigger companies had dozens of new things on their stand, many of them of considerable complexity. This made it difficult to genuinely expose the mind to a balanced cross section of the security technology available to the market.

Despite these challenges, there was much to be learned at Security 2017. The security industry is, more than ever, about relationships between people and between companies. This has always been a tight industry and the relationship game is more vital than ever. Change is getting faster and more profound. There is a growing emphasis on managing devices/inputs, rather than just building or enhancing devices. IVA – at all levels it’s growing and companies are leveraging it in lateral new ways.

And there’s a growing fatalism about the power of the big Chinese manufacturers. Hikvision, Dahua and to a somewhat less extent, Uniview, threw a huge weight of product at the market. As these new players have increased their market share at the expense of traditional manufacturers we see fewer new releases from more mature players and in some cases, these releases are of lessor quality than we’d have seen in the past. Some seem to be competing at the low end, others at the upper end. Meanwhile, the Big Three compete with unparalleled vigour at the lower end, the middle and the top end of the market.

I looked for short cuts in their respective ranges but saw few. They seem to build powerful, yet affordable solutions just to prove they can and the speed with which they’ve got their engineering teams around complex technology is breathtaking. This is not to say there are not brilliant products coming from other manufacturers – there are and many of them are the best performers on the market though at a higher price. But these players are going to need to be very competitive in features, quality and price to keep up. What is clear is that they won’t keep up for long by comprising quality and slashing R&D investment to defend margin.

There’s one area global manufacturers are clearly ahead – software – they have decades of experience and it shows. At Security 2017 software was more dominant than it has ever been and none of that clunky-looking MS root directory-driven stuff, thank you very much. The latest solutions are not just slick, they are simple and by that I don’t mean they aren’t clever. Instead they have very pointed operational focus. Even relatively modest solutions are backed by sweet management solutions the explaining of which was never so easy.

Last year in this feature I waxed lyrical about the wave of connectedness that is sweeping up behind us to overwhelm electronic security – that wave is moving through the market in ways it’s hard for any commentator to predict. During a conversation on the show floor, I think it was with Mobotix’ engaged and engaging CEO, Thomas Lausten, the word chaos came up to describe the utterly disrupted state of the market. We agreed that this state of technological frisson may be the new normal – anything and everything may increasingly be possible on the back of powerful infrastructure, elevated user expectations and the willingness of manufacturers and integrators to test every potential niche in every possible market.

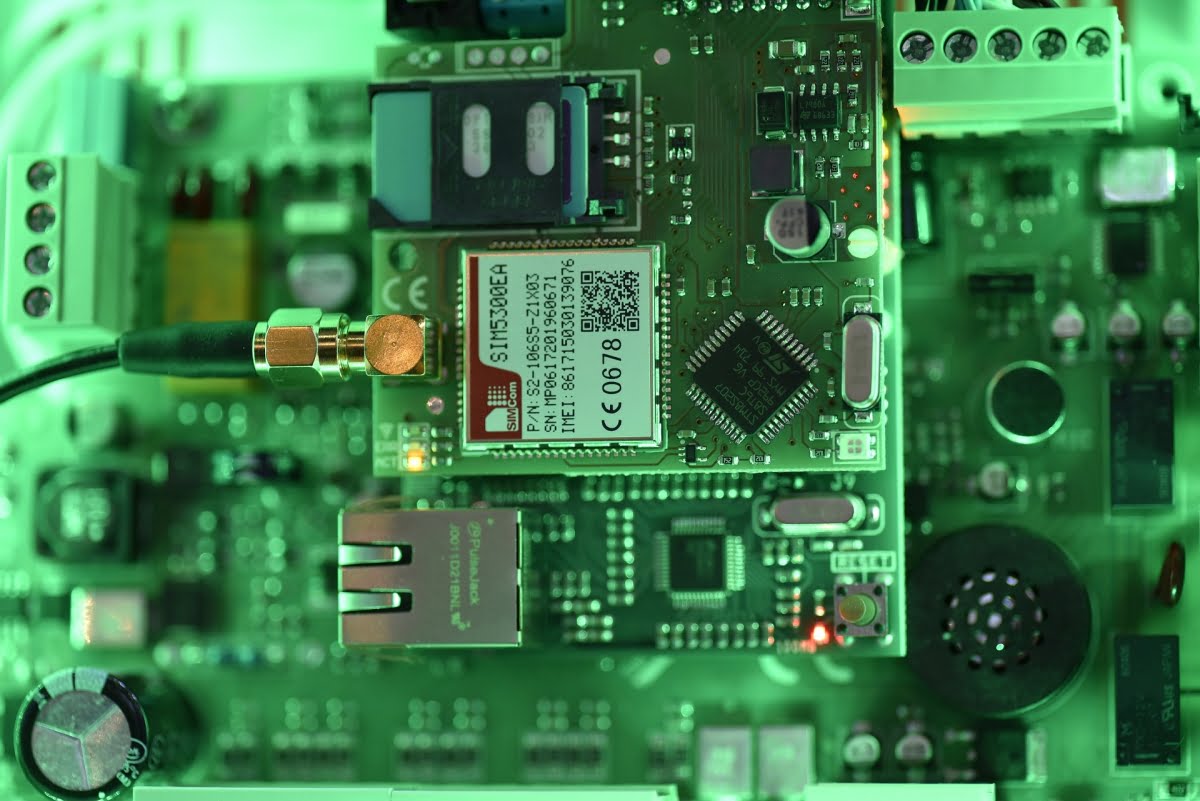

On the first afternoon of the show I spoke with Dale Acott and Chad Wright of SCSI, whose plans for the future of their company include engaging with the vertical in profound and disruptive ways that they argue are the only way to ensure the survival of their entire market segment. Will solid state alarm panels survive the coming networking shift – a change governed by loss of rebates, changing user expectations and growing possibilities? Acott and Wright argue that ultimately, they will not and the SCSI team is adjusting its business model to meet this future.

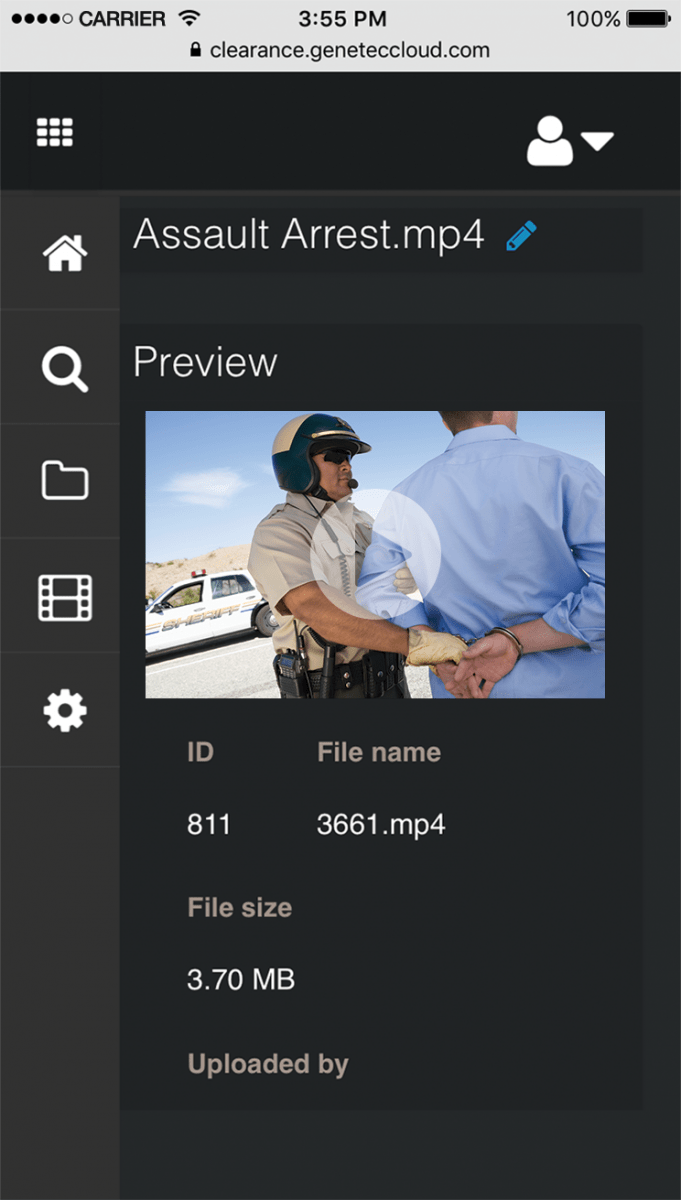

On the Genetec stand, Lee Shelford observed the company was not a security company but a networking company – what he meant by this was that Genetec’s often brilliant operational expressions of management software have lateral applications that apply to almost any challenge input sensors might deliver on behalf of Genetec’s customers. In the case of Genetec, these solutions include Retail Sense, which allows leveraging of retail video systems, Genetec Clearance, which supports law enforcement investigations and Mission Control, which is a management cockpit from which situational awareness can be established and all connected systems managed.

The key thing about Retail Sense and Genetec Clearance is not only that they are devoid of flummery and utterly operational, they are cloud-based. This should come as no surprise to Genetec users – Pierre Racz has been preaching the doctrine of cloud for many years. For the longest time, no one quite believed Racz but he was right after all. At Security 2017 people on unassuming booths in far corners were unveiling cloud stuff with the exultant air of those who yesterday fused atoms at room temperature.

Something Racz has always pointed out is that cloud is simple at heart – a label for services provided via the internet. Bosch’s James Layton describes cloud in another way – someone else’s computer. But this simple thing also offers the potential for complete disruption. Considered in this way perhaps it’s this disruption that makes cloud seem opaque. It’s not the technology we don’t understand but our own cognitive dissonance we struggle to penetrate. We know cloud works, we know it is the lord of all acronyms, including important little ones like TCO and ROI. But we can’t accept a cloud shift that means stepping away from so much of the physical stuff we think of as being integral to electronic security. Our mental struggle seems to be played out in business plans as well – so many companies have a foot in technologically disparate camps – very few of our cloud providers (Risco and Salto spring to mind as noteworthy exceptions) have let go of the past and struck out into the vast possibilities of open sky.

Of course, there are some companies who are making core changes – I’ve mentioned SCSI – but they are a comms outfit and for them devices are a means to another end. One big hardware maker really in on cloud as a whole-of-business strategy is Bosch, which has teamed up with AWS and is driving cloud not just from the point of view of its security business but as an integral part of its entire business. Bosch talks cloud in a profound way, an IoT way – controllers, appliances, the components of cars. When you talk with some Bosch people about the possibilities of cloud and IoT you can almost hear the thrumming of an electronic hive mind.

Although the company has a long history of software development, Bosch is an interesting case given the company makes such sweet devices in so many industries – controllers, cameras, sensors, a multiplicity of industrial components – and from the point of view of the market, paying attention to the way Bosch moves forward is likely to pay dividends. There’s no chance that implementation of connectivity to all Bosch devices is not going to catapult the company’s technology forward at an exponential rate. Accelerationism? I think it is but more on that later.

Talking about cloud reminds me of a conversation I had with Uniview’s softly spoken and thoughtful vice president, Ximen Yan on the SEN stand. It’s important to bear in mind here that Uniview is a networking company which also makes excellent surveillance cameras. Will Uniview out-compete the big device builders, Hikvision and Dahua? Probably not. But its primary strength lies in networking, meaning it is free to take the market in new and disruptive directions. Asked about the importance of cloud to Uniview’s future, Yan quietly observed: “Cloud is very big in China, much bigger than it is here in Australia.”

We are used to thinking of cloud as the support infrastructure for what pros think of as toy systems – little collections of cheap security devices often bought from retailers that are monitored by Jane Citizen on her iPhone to make her think she has a smart home. But cloud, real cloud, is about professional services – secure, reliable, redundant. If you have any doubts about the veracity of the model consider the U.S. Army has a $US50 billion contract to take its networked infrastructure into the cloud and it’s one of dozens.

The flexibility and ubiquity of management solutions of all types is such that they are no longer about what the provider can offer but what the end user requires at any given moment. Today, a smart software team can tweak and upgrade code with minimal operational latency, responding to changing needs with unprecedented speed and power. And systems are built with integration in mind – you’re not calling in an engineering team to create code to support your sub-systems but ticking checkboxes from your laptop, which could be anywhere in the world.

Looked at in this way, we really have come to a new place – not all systems at once but all systems inevitably – a place in which orchestras of electronic security controllers, field devices and integrated sub-systems are conducted by management solutions and their providers in a way we’ve never seen before. And having reached this place, change is likely to gather momentum in unexpected, unprecedented, unstoppable and for many competitors, utterly necessary ways.

In the days after Security 2017, I reflected on the conversations I’d had and concluded that the electronic security industry is in a position that might be loosely compared to the plot of Roger Zelazny’s techno-religious novel, Lord of Light. In the 1967 book, the uptake of technology must be driven forward at an unprecedented rate to give the characters any hope of survival. The role of distributors and integrators somewhat mirrors the eventual position of the central character, Sam, who fights to bring the newly developed technology to the masses.

Undoubtedly the most interesting aspect of this book is that it’s considered seminal to the development of the technological epistemology of accelerationism – simply, the notion that computer technology, including infrastructure, storage, processing, management solutions and their intrinsic useability and reliability (think power, maintenance, security), must accelerate – massively – if the global business model is to survive. And this acceleration creates a feedback loop into surrounding areas of technology – think artificial intelligence, centralised automation and lateral and vertical connectedness – that amplifies the larger process in the same way the application of a small voltage massively increases a larger voltage in a transistor.

The attractiveness of accelerationism as a way to think about the electronic security market is that it enables a whole-of-technology mindset, rather than trapping the thinker in a pond of natural self-absorption in which one’s own solutions comprise the lens through which all technology may be viewed. Through the prism of accelerationism, we can better understand Telstra’s supercharged release of as-yet undefined 5G wireless, slated for 2020. Whether the Australian Government realises this or not, Telstra is creating a rocket-propelled wireless infrastructure that will leave NBN Corp holding a very large baby dinosaur and the Australian taxpayer clutching a bill for tens of billions in exchange for a contention-riddled service worth half its cost they will not want to pay to use.

Thanks to accelerationism we can understand Hikvision’s seemingly off-beat release of a 4G-enabled PTZ camera that offers users a 50MB wireless pipe and dispenses with cabling altogether. Sure, the camera is for mobile applications but why not for every camera? And if for every camera, why would it not be managed by secure cloud? Now it’s possible to see that the SCSI boys aren’t just echoing the pioneering spirit of founder Steve Acott when they talk about the finish of solid state alarm panels but are themselves hammering out a new technological breach. Accelerationism explains why integrator and technology developer 3Crowns Technologies (a spin-off from highly respected tech house and integrator, Coastal Comms) is planning to bureau cloud-based video surveillance for third-party installation companies using its own proven and highly-evolved network infrastructure.

Accelerationism fleshes out the notion of Dahua’s unitised solar-powered wireless solution, supported by long-range wireless and compatible with cloud. It embraces automated drones driven from anywhere, Bosch’s decision to run hard with AWS, Genetec’s arrowhead software solutions, each precisely engineered for the mark. It underscores Seagate’s new constant duty 12TB enterprise-grade drive, explains why Dahua is releasing industrial-grade networking devices and wireless comms, why Hills has released a lateral cloud solution like HillsTrak, why HID keeps driving ahead with its agnostic IP-based VertX access control solution and mobile device authentication solutions, why CSD is leaning in hard with SkyGuard, why ISONAS is having success with Pure IP and Pure Access Cloud and the new RC-04 reader controller.

It also explains the driving force behind Nx Witness’ new Cloud-enabled architecture, which offers the ability to connect from anywhere to your system with just an email address and a password. Nx Witness was always a clever system that actively worked to support operators and investigators. Now there’s new architecture alongside what the company describes as a ‘screamingly fast mobile app’ (pared back for maximum operational efficiency and cleverly applying compression), making Nx Witness smarter still.

The changes also explain releases like ComNet CopperLine, which supports extended distance transmission for network comms over coaxial or twisted pair cable, with the coaxial medium specified at RG59 or better and the twisted pair CAT5 or better. At 100Mbps, distances extend to over 600 m on the minimum grade cable and if data rates 10Mbps distances can be up to 1500 m on RG59 coaxial cable. CopperLine provides support for PoE at either the 15.4W (IEEE802.3af) or 30W (IEEE802.3at) power levels – as you’d expect power levels are dependent on link distance.

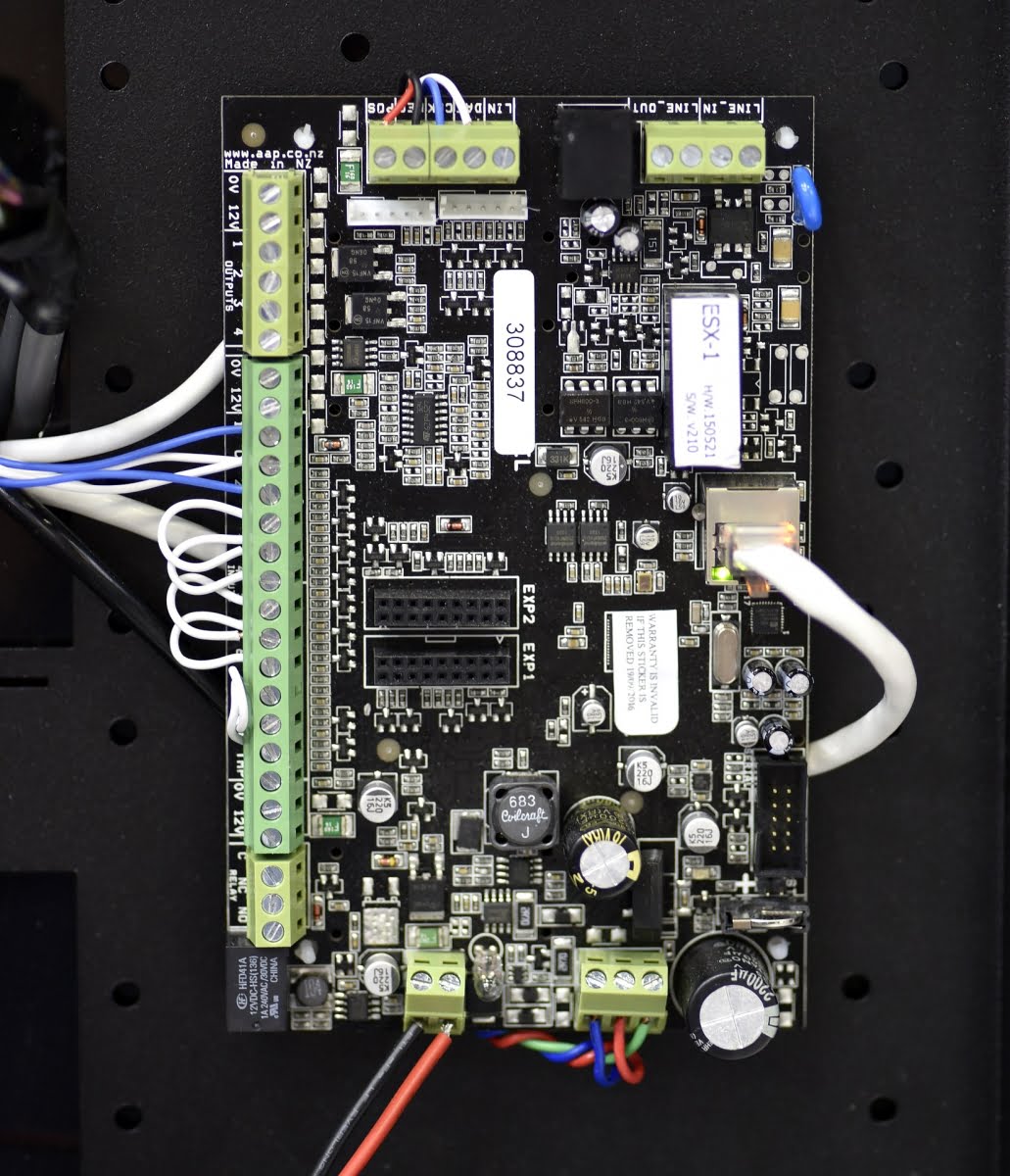

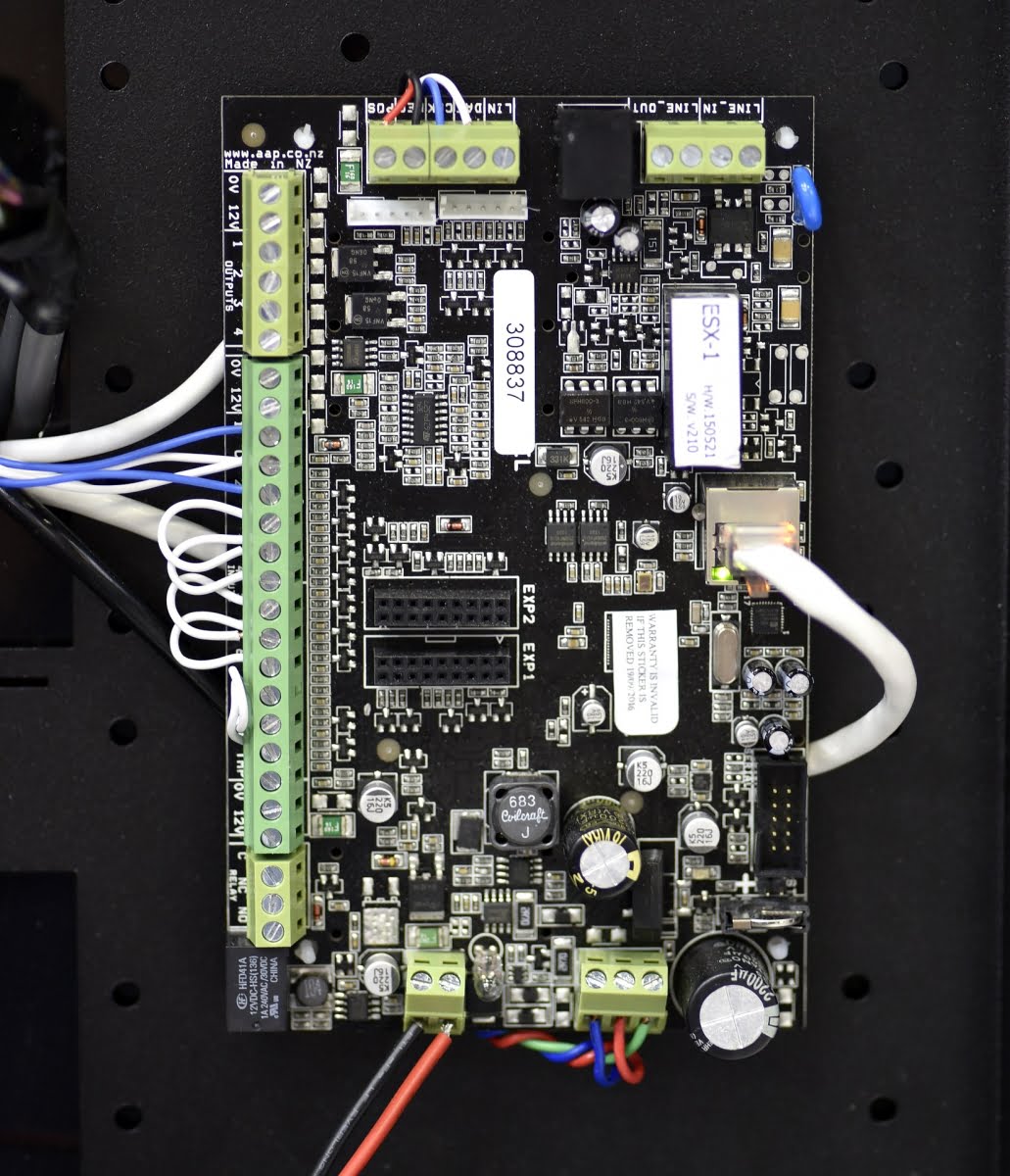

Perhaps a bigger deal still for this networking infrastructure specialist is that ComNet is dipping into access control for the first time with the CNA100 line, a 2 to 8-door solution for smaller applications and the CNA200 for up to 32 doors for bigger applications (the CNA100 can be expended to 32 doors with a software upgrade. CNAccess controllers feature embedded intelligence so there’s no need for dedicated software or PC, allowing users to manage a system from any location with internet access. There’s support for Wiegand, Schlage AD Series electronic locks, and various card formats and technologies such as proximity, smart card, magnetic stripe and Bluetooth.

The race to the future is also behind Avigilon’s increasing push into intelligent video analytics – the company’s Appearance Search took out second place in ASIAL’s Product of the Year Award – a worthy winner, in my opinion. The ability to get value out of all these billions of electronic security inputs globally is going to be central to the technological challenges that are ahead. Avigilon makes quality surveillance cameras and management systems, no doubt, but the potential of Appearance Search and its variations, including Appearance Face Search, are enormous – bigger than security applications could ever be.

Tecom C4 deserves a mention here, too. It’s a single interface that allows management of all security systems, access control, intrusion and CCTV, whether local or remote, from a single workstation. Operators can commission, drive and manage all their systems from a single interface, no matter the manufacturer, and there are multiple reporting options, too. Behind the scenes is an MS SQL database with Open DataBase connectivity. The strength of C4 is the huge list of integration drivers that have already been written and the fact new drivers can be written using integrated tools by any developer for any user – accelerated evolution is written into C4’s DNA.

The trouble with listing the ways the electronic security industry is experiencing its very own version of accelerationism on a product-by-product basis is that they never end – almost every company is in on the act in some way, driving technology forward at an ever-increasing rate and in doing so, shifting user expectations forward from old ways as they battle for growth and for future survival.

What were the other trends at the show? I think the price falls in video surveillance are going to be realised in the access control market over the next 5 years. Access control is a nebulous beast. Major end users with serious and intricate needs are not going to be attracted to low end gear – they want absolute surety their chosen solution will deliver across multiple primary and vital sub-systems.

Having said this, at the lower end, smaller enterprises are likely to be drawn towards lower cost controllers if they are distributed from a national footprint and given proper support. What this shift may mean is that users get more features for the same money but I’m not certain there’s not going to be a significant price breakthrough in lower end of the access control market. What that means for installers is that they’ll have more options to choose from and an enhanced margin.

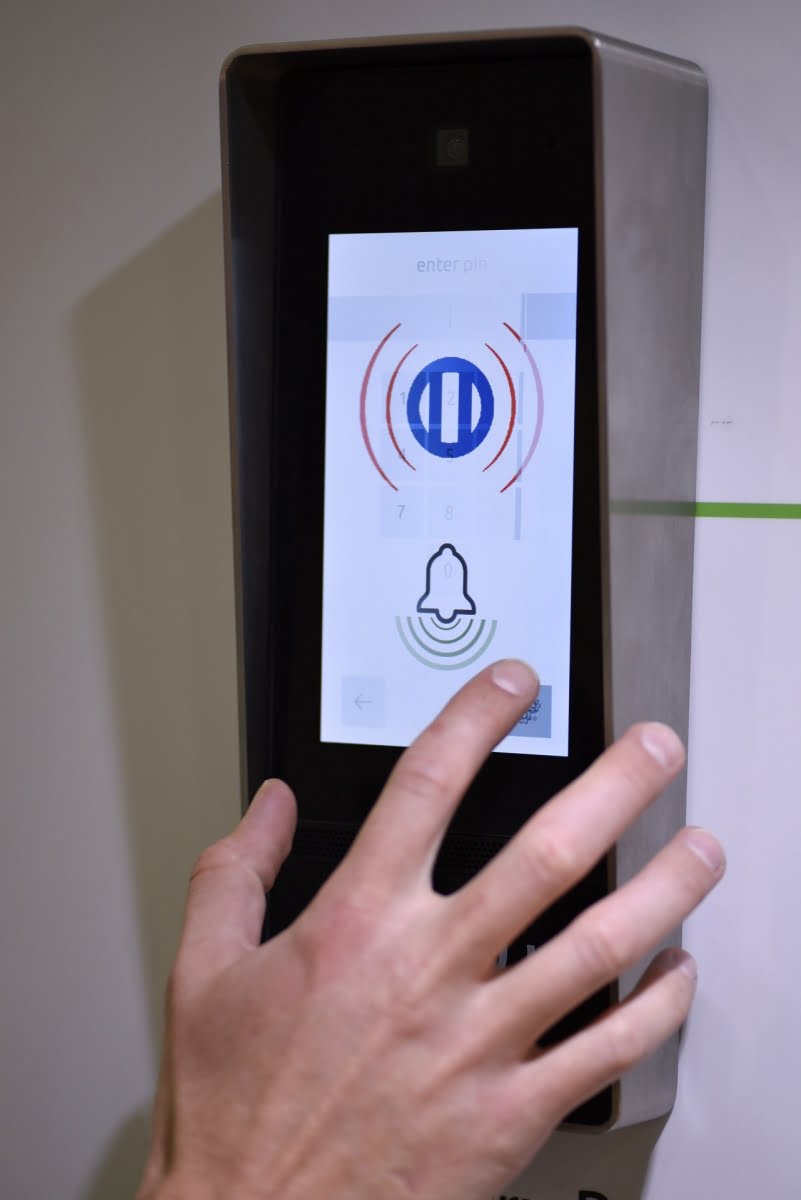

Biometrics was another trending technology at the show and what was notable was that it wasn’t just coming from higher end providers but there were suppliers of affordable biometric solutions, too. I liked the solutions I saw from CSM and Security Distributors Australia, as well as EDS’ proven Morpho gear and the sweetly designed stuff from NetDigital.

The siloing of days gone by – yes, that is still going on. Sure, everyone is building ‘open’ systems and many have a cloud-based solution but these systems sheet the money trail home to one provider, whether it’s cloud-based or not. Business is business after all. What this means is that interoperability, while it’s improving, remains in short supply outside of co-dependent providers like camera makers and VMS developers.

Stuff we liked at Security 2017

One of the hard parts of laying out the kit you liked at a big tradeshow is knowing in your heart you didn’t see everything. There were corners of the hall to which I never got and who knows what marvellous contrivances were displayed there. Taking this into account the crosshead above should read “Stuff we liked of the little we saw at Security 2017”. And you could be forgiven for thinking there were no devices at Security 2017 after reading that intro – there were devices – constellations of them, better and more capable than ever before.

I might as well get the big one out of the way – Hikvision Darkfighter X – I don’t really understand how dual sensor technology works just yet and nor did I see what was in the box in-back of the stand but if Darkfighter X is really that much better than the current model Darkfighter Hikvision aficionados are in for a real treat. Typical with Hikvision, the X comes in multiple form factors at once on first release – you’re not going to be waiting around years for the PTZ version to show up after the bullet camera hits shelves. I think it’s instructive that Hikvision has released this important new camera as bullet and PTZ, not box. That decision must be based on weight sales.

Hikvision showed a ton of new stuff – cameras in all shapes and sizes and targeting all sections of the market – tiny pinhole cameras, transport cameras, people counting cameras, thumping great explosion-proof cameras and loads more besides. I was especially attracted to the new range of transport solutions on the Hikvision stand, as well as a magnetic Darkfighter PTZ with a 4G slot which you pop onto the top of an emergency services vehicle to give a high quality live video feed. Oh, and the ANPR dome camera – very nice indeed.

Another strong new release at Security 2017 was the Australian-developed Osprey radar system, which is designed to detect all attempts to get contraband into the prisons by throwing or slinging it over walls or fences. The management solution is a highlight of this clever solution. Up until now there has been no way to detect and monitor small packages containing tobacco or drugs passing from the public side to the sterile side of prison perimeters. Osprey is the answer – importantly it’s fully supported by NSW Correctional Services.

Dahua showed a bunch of cool things at the show, including Best New Product Award winner, the NVR-5224, which features 24 PoE inputs with 800m range, and offers H.264 and H.265 compression options. Particularly neat from Dahua was a carbon fibre drone, the X820, which is designed to be used for a range of surveillance tasks, from checking alarm events to monitoring developing fire fronts in rugged terrain. Perhaps what was most interesting was the spec. This drone is monster with a potential 1500m ceiling (where authorised), nearly 40 mins of flying time, a 10km remote control range and a top speed of 90kmph.

The X820 has a 6MP Sony Starvis CMOS sensor and an optional thermal camera, ideal for monitoring outbreak of fire or searching for lost hikers in tough terrain. It will also broadcast its video feed live at 1080p resolution if locked to hover above an incident or threat. Dahua’s stand was all about solutions – it included the solar camera mentioned earlier, as well as a smart city emergency phone tower, industrial-grade networking gear, a thermal PTZ, a thermal and optical bullet, 4K HDCVI and plenty more besides.

At the Consolidated Security Merchants stand, I liked the new TVT gear. CSM has already put together a nice suite of intrusion panels, access control gear and has the affordable new InBIO biometric solution for small business applications. TVT gives the company an excellent CCTV range at pointy prices – 1080p and 4K in all compact form factors, including domes and remote varifocal bullet cameras. It’s hard to break into the market with new CCTV cameras but I think TVT will manage it.

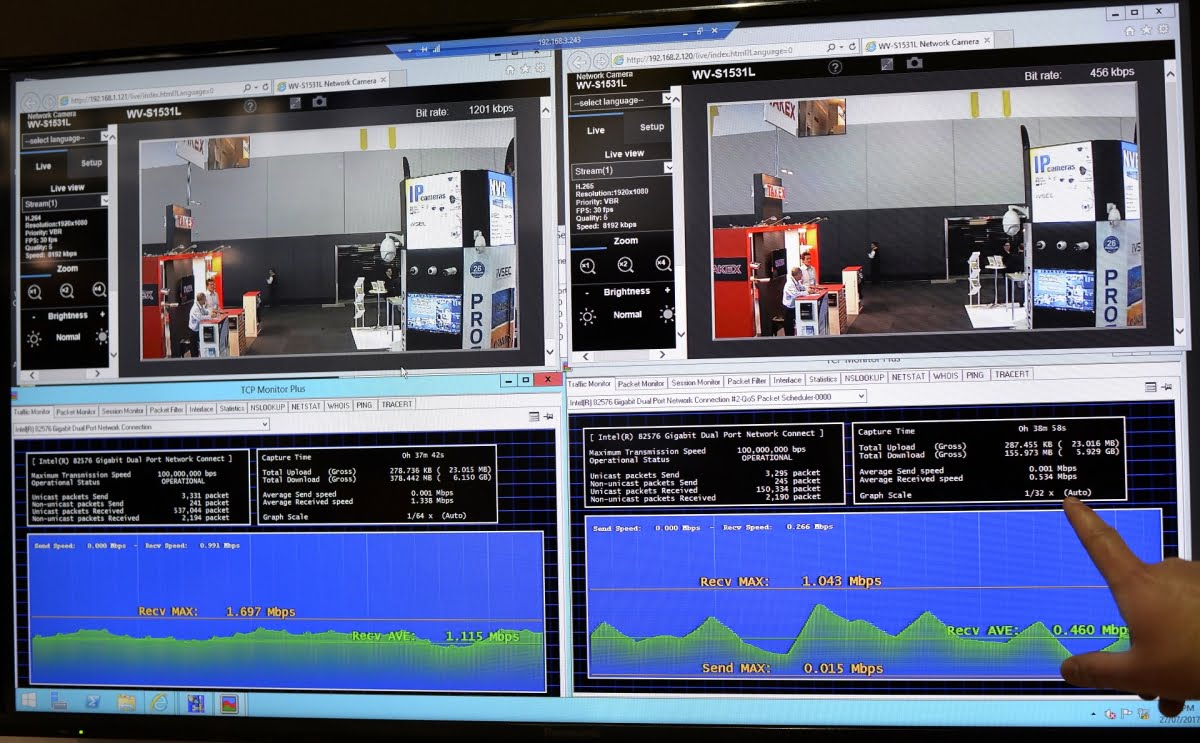

Panasonic was showing its Aero PTZ, locally distributed by BGWT – it’s a great pedestal PTZ designed to handle severe weather conditions while retaining situational awareness. Panasonic also had a new rugged PTZ on its stand – the spec is similar to Aero optically – and the build quality looks extremely good. Panasonic also played up its strengths on the management side.

As mentioned, Uniview showed a bunch of new things in partnership with local distributor, C.R. Kennedy. There were plenty of new cameras, some of which we saw at SecTech – the Starlight with a beautiful, fast varifocal lens was my personal favourite, though many users will prefer domes and bullets. Then there was Uniview’s UNV Unicorn – a 2000-channel VMS server. With 16 HDD bays expandable to 48, and support for 100 online users at a time, the UNV Unicorn is a serious but of kit that might be perfect for many quite large applications.

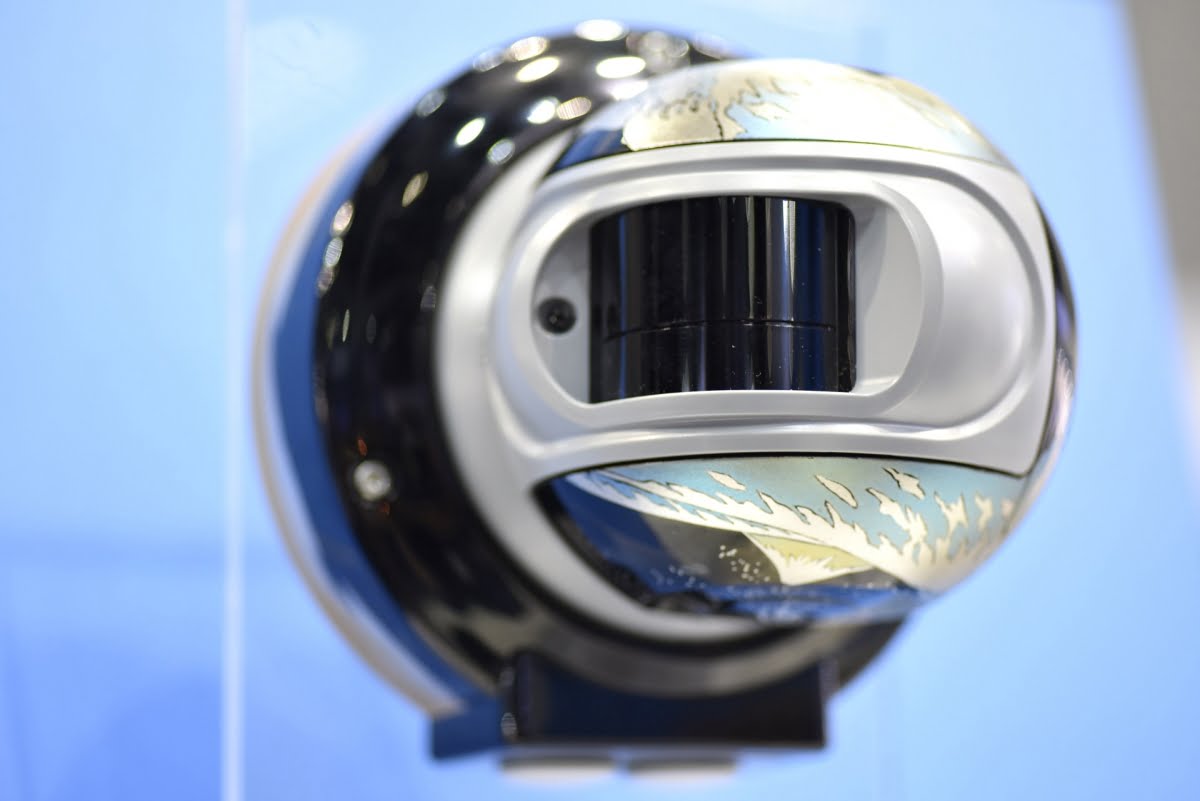

ATOM AR3S from Amaryllo International took third place in the Best New Product Award at Security 2017. It’s a very compact PTZ camera with a small size that belies its functionality. Using powerful onboard processors and smart software, it can proactively recognize faces, has duplex audio, and auto-tracks intruders in 360-degrees without the need for remote computers. Having IP66 rating means the camera is capable of external application. Embedded with dual-core CPU, ATOM AR3S can decipher military-grade 256-bit encryption offering the highest privacy protection in the world.

Mobotix released its M16 Thermal Radiometry camera at Security 2017. We like thermal cameras and with Mobotix well and truly hooked up to open platforms, it’s hard not be warm further to the company’s robust surveillance offerings. Teamed up with MxActivitySensor, thermal is a killer for serious surveillance applications. The newly open Mobotix is a company to watch in my opinion. We’re going see some clever things from Mobotix in the future.

Sony showed some things we love – the VB770 – and some things we think we will come to love – in the latter case, the Exmor R CMOS sensor-powered SNC-VB642D. This camera is a robust and compact external bullet camera with integrated IR that looks like it would be at home in multiple applications. It has remotely switchable white light at the top of the array and IR at the bottom – fantastic. Sony’s new G6.5 range includes 4K in an affordable form factor and the on-screen performance looks great.

FLIR is a company that’s easy to underrate when it comes to security gear. This is a beast of an organisation with serious mil-spec pedigree and deep R&D pockets. FLIR considerably increased its CCTV range in the recent past through acquisition and showed a heap of new stuff. I was particularly impressed with some of the new surveillance form factors, with excellent bullet cameras having shrunk to less than half their former size with no impact on specification or performance.

I got a quick look at the FLIR Cameleon Tactical system, which is designed to provide security and surveillance applications in a highly customizable and user-friendly environment. Cameleon is designed to control any number and combination of analogue and IP devices from different manufacturers with point and click simplicity, ensuring retention of those costly investments in security and surveillance equipment.

FLIR Ariel 3MP Corner Camera has a is designed to slot into corners and features an extended FOV lens that provides ceiling-to-floor and wall-to-wall coverage without blind spots. It can handle low light and has IR support. Most of all, it’s handsome and purposeful-looking in the flesh, same as most the FLIR hardware. When I was going through the images I took on the FLIR stand it was tough to curate them – I liked everything I saw – the Quasar 4K, the thermal bullets, the 12MP hemispheric.

Something at the show I paid more attention to than usual were bollards – brands on display included BFT and FAAC’s J275HA Automatic retractable traffic bollard, which is not new but we will see more bollards and this is one of the best. The J275HA is designed for applications where there’s a need to raise and lower serious barriers in order to allow access but it also means the bollards can be lowered until raised in the presence of material threat by the operators in a smart city control room.

On the Gallagher stand, the Class 5 systems provide high security protection against sophisticated attacks to intruder alarm system. Gallagher also showed its powerful access controllers and powered fencing solutions. Gallagher exhibits have long tended towards solutions and this one was no exception to that rule.

CSD and Inner Range had a combined display. I liked SIFER keypad, EyeLok biometric reader, the EliteX RAS, the Paradox-powered SkyGuard solution. Inner Range has also been working on software upgrades to pivotal products like Inception. The CSD-Inner Range display was arguably the heart of the show in my opinion and the performance of the display, which combined product displays and a break-out area to meet and greet underscored the relationship-centricity of our industry.

Security Distributors Australia showed many new things alongside the still quite new Net10 controller. These included a handsome Paxton door station and biometrics from ievo. I was also taken by STid Mobile ID, an authentication system based on smart devices. It includes a free mobile app, latest generation multi-technology Architect Blue readers, and online and offline configuration tools. Especially cool was the way you drive the reader without getting out your phone by running your hand down the face of the reader.

Hills showed a typically wide spread of products and these reflected the company’s strengths as well as its anticipation of where the market will go. I saw the latest things from Kantech, Ruckus, Vivotek, Hills’ own Pacom-branded solutions, as well as intercoms, access control, management solutions – it goes on and on. Of special note was HillsTrak, a cloud-based asset tracking solution with whole-of-business, as well as security, applications. I got a quick demo of this solution on Day 1 and liked what I saw. As a manager, you might worry a comprehensive asset tracking and asset management solution of enterprise scale would be fussy but with HillsTrak, that’s not so.

This cloud-based system is thoughtfully conceived and has a fundamental simplicity designed to reduce the steps required to get any of the layers of a complex and demanding job done. When it comes to managing anything, this is very important. Of all Hills’ attempts to create a lateral cloud business, this one is by far the best.

LSC has been pushing into intrusion and access control this year and the company’s display reflected this – AMC controllers and multiple devices – wireless and hardwired – for a range of applications. These AMC controllers look well-made and they’re both large enough and affordable enough to apply to many applications. The new touchscreen was a clever thing. Importantly, LSC is one of the security industry’s oldest companies guaranteeing that vital longevity of service and support.

ISCS had a big open stand towards the front of the hall and was showing off a diverse range of equipment, including ICT’s Protege access control system. ISCS is company that should not be underrated – it has a serious range of quality brands alongside ICT – Sony, Suprema, Salto, Nedap, NxWitness and a bunch of other cool things.

Bosch showed access and intrusion controllers, keypads and touchpads, Vera Z-Wave smart home devices, as well as a new CCTV range, which combine affordability and performance. Alongside the new things was Bosch’s MIC PTZ, which we loved so much last month. Mounted high above the stand, MIC undertook an automatic tour schedule but the space was too small to demonstrate just how capable this camera really is – you need to get the beast outside for that.

EDS showed a new management solution that it’s offering alongside the software agnostic HID VertX access controller – we’re going to be reviewing that management solution in the near future. As mentioned, EDS also carries the Morpho range and there was plenty of that on show, very high end and more affordable solutions, as well as IrisAccess readers and the HID iClass SE platform.

On the Alarmcorp stand, I liked the Vanderbilt AC5102, which supports 500,000 cardholders and 96 doors, and offering proximity and keypad reader options. The AC5102 has 6 separate field level network (FLN) channels. Each FLN can host up to 16 local devices for access control‚ monitoring input devices or controlling output devices.

Conclusion

This precis is mere fraction of what was new at Security 2017 – it was nigh on impossible to see everything. Regardless, we can draw some strong conclusions about our industry and its technology. Relationships are everything, the underlying technology and the devices on offer are so flexible as to allow installers, integrators, end users and consultants supreme flexibility in applications large and small.

There’s a reason consultant Doug Grant includes LPR, thermal, optical (fixed, bullet and PTZ) cameras in nearly all his applications – it’s because he can, and he can do so affordably in a way that gives customers a powerful sense of return on investment. A single form factor and camera spec for every field of view in a sprawling internal and external application with multiple potential targets? How could a clever salesperson ever sell so thoughtless a system design on any hook but cost?

There’s an overarching sense of change in our industry, regardless of the number of cool hardware devices on offer. You’d have to be blind not to see that even famous brands are leaning towards low cost ubiquity in many areas – alarms, access, CCTV. At the same time, people are talking about and thinking about the solutions stack in new and flexible ways. When you are fundamentally an IT-based industry, you don’t have to go far down the path of change before everything looks completely different. That’s how Security 2017 felt to me.

It’s not all bad by any means. Monetisation permitting, our technological future is going to be anything but boring and the chance the operational imperatives of security teams will alter in any small way are zero. But suppliers are going to be meeting expanded threats in new and more flexible ways. Thanks to what I think is a clear case of accelerationism, it’s hard to know exactly how the future will play out, only that change will snowball and will happen faster – where we will end up in a future of automation and AI is extremely difficult to say.

I think back to those conversations with Thomas Lausten, Lee Shelford, Dale Acott, James Layton, Ximen Yan and many others – conversations about our runaway future – then consider us as we are. A technology-based industry with a vital social and civic role – pulling multiple data strands to deliver critical intelligence in real time. It’s hard to argue that the application of Arthur C. Clarke’s Third Law is not appropriate when thinking about the future of the electronic security industry: “Any sufficiently advanced technology will be indistinguishable from magic.” ♦