Alarm.com reported fourth-quarter earnings adjusted for non-recurring items of 43 cents per share, beating the Zacks Consensus Estimate of 33 cents per share – up 26 per cent year on year.

The company’s latest quarterly report represents an earnings surprise of 30.3 per cent. For the previous quarter the company was projected to post earnings of 32 cents per share but instead produced earnings of 37 cents, delivering a surprise of 15.63 per cent.

Fourth-quarter SaaS and license revenue grew 15.7 per cent from the same quarter last year to $90.1 million. This includes Connect software license revenue of approximately $10.6 million, down from $10.7 million in the year-ago quarter.

SaaS and license revenue for the Alarm.com segment grew 14.6 per cent in the fourth quarter, while the company’s other segment grew 34 per cent year-over-year, driven by strong results at subsidiaries including EnergyHub and PointCentral.

Full-year SaaS and license revenue in 2019 increased 15.9 per cent over the prior year to $337.4 million. The Alarm.com segment grew SaaS revenue by 14.2 per cent year-over-year; the other segment grew 51.6 per cent in 2019.

The company had a SaaS and license renewal rate of 94 per cent in the fourth quarter. Hardware and other revenue in the fourth quarter was $50.4 million, an increase of 50.2 per cent over Q4 2018.

During an earnings call with analysts Tuesday, CFO Steve Valenzuela said the increase in hardware revenue was primarily due to an increase in video camera sales and to a lesser extent the inclusion of the company’s acquisition of OpenEye in October 2019.

Total revenue of $140.5 million for the fourth quarter grew 26.1 per cent from Q4 2018. For 2019, total revenue grew 19.5 per cent to $502.4 million. SaaS and license gross margin for the fourth quarter was 86 per cent, up approximately 90 basis points from Q4 2018 gross margin of 85.1 per cent.

Hardware gross margin was 20.8 per cent for the fourth quarter compared to 18.8 per cent for the same quarter last year, primarily due to product mix, Valenzuela said. Total gross margin was 62.6 per cent for the fourth quarter compared to 65.1 per cent for the same quarter last year mainly due to the increase in hardware revenue, he said.

Fourth-quarter non-GAAP adjusted EBITDA increased to $30 million, compared to $20.9 million in Q4 2018. Full year non-GAAP adjusted EBITDA increased to $108.3 million in 2019, compared to $93.1 million the prior year.

Alarm.com said SaaS and license revenue in the first quarter of 2020 is expected to be in the range of $89.9 million to $90.1 million.

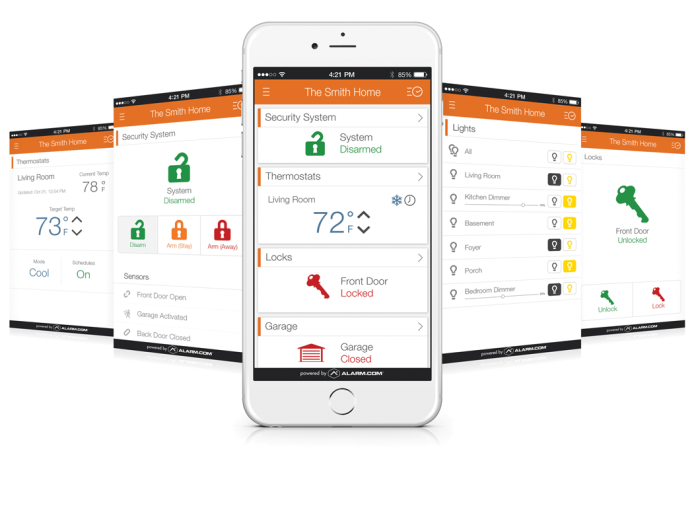

More than 9000 service providers currently sell and service Alarm.com technology to customers in more than 6.8 million properties in over 40 countries. The company manages more than 100 million connected devices and sensors through its cloud services.

#securityelectronicsandnetworks.com