What were the key product and technology releases of 2013 and how will they impact on the future of our electronic security business? And what broader developments look set to impact on us in 2014?

YEAR’S end is the perfect time to take a moment to think about the pivotal product releases of the previous 12 months. I think 2013 hasn’t disappointed. While there have been a number of new software products of note, there have also been strong hardware releases in CCTV, access control and intrusion detection.

We’ve also seen the release of broader technologies that are certain to impact on the business at multiple levels in the years ahead. Part of me thinks such releases may alter the business fundamentally, while another part thinks they’ll simply broaden our opportunities and enhance the ability of our systems to support end users and integrators.

Cloud was the biggest new technology of 2013. There were cloud-based releases in access control, video surveillance and intrusion detection. Another key technological trend in 2013 was mobile access to alarm, access and video surveillance systems. Yes, we’ve seen this sort of thing before but when it starts coming from alarm manufacturers whose sensors have cameras inside them, I think it’s fair to say remote apps have arrived. There are case-by-case risks associated with this technology but it’s certainly here to stay.

A couple of other things that were of interest include the release of 4K monitors and mid-term plans for 4K cameras from the likes of Bosch and Sony. Then there was the appearance of biometrics in Apple’s iPhone 5. As well as resolving the security industry’s worries about user authentication during remote sessions, biometrics in smart phones would be a big deal for the access control industry. It would legitimise our very mature biometric authentication technologies. Online fraud is becoming so pervasive I seriously think biometric authentication is more necessity than choice.

Another development worth paying attention to in 2013 was wireless data networks. We’re all up to our necks in IP but wireless networks from the likes of Fluidmesh and FireTide add a level of flexibility and reduced installation cost that opens opportunities. Public surveillance applications, brownfield sites, quirky remote building applications. Better wireless technology means a better electronic security business.

“Chinese product is CCTV mostly but companies like Chuango make some very nice alarm panels and the chances they won’t reach us are zero”

Mainland China manufacturers. Yes, most everyone manufactures their stuff in Chinese factories anyway but Chinese electronic security developers started pushing into the local market more strongly in 2013. The quality of Chinese CCTV equipment is comparatively high and price is attractive, while the product ranges of companies like Hikvision are extensive. Chinese product is CCTV mostly but companies like Chuango make some very nice alarm panels and the chances they won’t reach us are zero.

Chuango CG-B11

The cancellation of Australia’s National Broadband Network. The politicisation of the NBN has muddied the waters so much it’s hard to know what the market is going to be getting in the way of broadband. Clearly, Telstra is going to be the dominant player. What speeds we are going to get depend entirely upon network contention. It won’t be the quoted 25Mbps down and 4Mbps down, that’s for sure.

I do think that for the Australian security industry, Gigabit NBN would have been an enabling technology the likes of which the industry has never seen before. We will rue its lack in the future as all our comms highways get more and more crowded.

“As the IT industry’s most powerful distribution business Ingram Micro is something wholesalers and distributors need to watch”

IT distribution. A number of companies are distributing their products to the IT industry through huge global IT distribution outfit, Ingram Micro. This is happening only in the U.S. so far but the model must spread. These companies include familiar faces like Axis Communications, Bosch, Mobotix, Exacq, Cisco, D-Link, Sony, Brickcom, Everfocus, Genetec, Panasonic, Moog, Milestone, Fargo, Ingersoll Rand, Paxton Access and others. Some have made their entire ranges available to Ingram while others have not.

It’s easy to see why manufacturers want access to the huge IT integration market but there will be ramifications for our distributors. Ingram Micro is openly pushing itself not as a box mover but as an end-to-end supplier, handling sales and pre and post-technical support. Nor is it promoting itself just to the IT industry but to security integrators as well. As the IT industry’s most powerful distribution business Ingram Micro is something wholesalers and distributors need to watch.

Network area storage manufacturers are stepping into video surveillance. In 2013 we saw this happening in earnest, with Synology and others displaying at Security 2013 Exhibition in Sydney. Why is it a big deal? You buy a Synology NAS with VMS is already loaded aboard. These aren’t the best VMS solutions around but they work well and these NAS units are widespread. For instance, SEN’s office NAS is a 4TB Synology.

Video surveillance

Given it’s such a large and complex business segment there’s plenty to talk about when it comes to video surveillance. The key technological trends in video surveillance include the growing prevalence of thermal, the release of cloud-based products and services, the introduction of 60ips in 1080HD and the leeching down of high-end chip sets into lower-end CCTV cameras for network and cloud applications.

Thermal was a big one in 2013. It used be just Flir. Now it’s Axis, Mobotix, Sony, DRS and Moog, too. The key thing is that mainstream optical makers are dipping into the thermal market. More players means lower prices means more sales means more R&D. Thermal is a topical application but the great thing about thermal is how well it works as an intrusion detection device. Thermal guarantees a catch and is indispensible for onsite security teams defending large perimeters.

Flir's FC-Series S thermal camera

Wireless was another thing that wicked up in 2013. As mentioned, we had strong releases from Fluidmesh and FireTide as well as ComNet’s wireless Ethernet transmission product, including NetWave, a commercial grade and industrially hardened point-to-point kits, as well as point-to-multipoint models. We also saw Wi-Fi HD cameras released by D-Link.

Continual packaging of processing engines into more and more diverse and lower and lower cost form factors continued. We also saw the release of products that combined a whole lot of good things for not very much money. You know. PoE, 720p HD, integrated storage with a decent lens for typical small business applications. Some have an LED for low light performance and a PIR for movement detection. It seems almost every manufacturer now has a basement range. This shows the industry is maturing and there are plenty of bigger and more powerful solutions for serious users.

As thoughtful readers will surmise, there’s something about these basic releases that has the potential to make a mockery of our Aussie installer licensing laws – particularly when combined with IT or online distribution. When IT techs or keen amateurs can build their own CCTV systems it changes the game at the price sensitive lower end of the market. There’s no doubt that when it comes to basic HD IP cameras, we will see a race to the bottom over the next few years.

Access control

In my mind the one of the biggest things that happened in access control in 2013 was Axis Communications’ decision to enter the market. I’ve not had a demo of this technology yet so I don’t fully understand how it works and can’t say anything about how robust it is. But given we are talking about Axis, I think we can say end-to-end IP and we can assume it will be modular and affordable.

If the move is successful, I think we can also assume there will be money thrown at product development. Of all the big CCTV manufacturers, Axis has been the strongest in new releases over the past 5 years. This compulsive targeting of niches is likely to carry over to access control. Further, Axis makes great CCTV cameras so there’s also going to be integration.

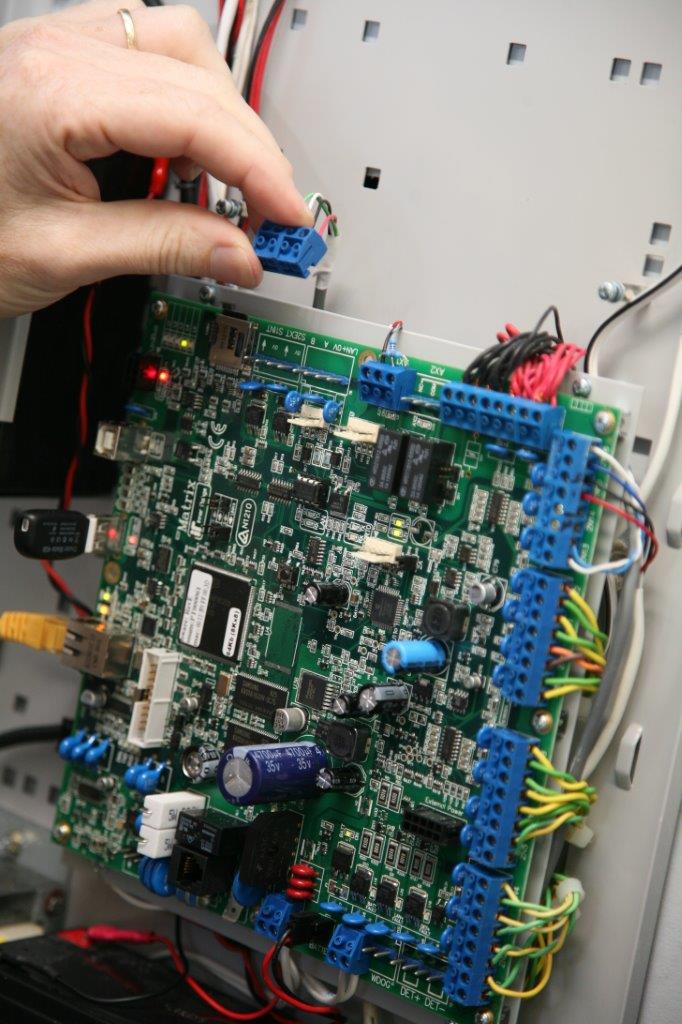

Just as big a deal was the release of Genetec’s Synergis Master Controller. SMC is a full-featured access controller that changes Genetec’s route to market. It’s an important release in a number of ways. It shows the centrality of hardware in facilitating the distributed intelligence of access control solutions and it makes Genetec a real access control manufacturer.

Genetec SMC

ONVIF released its Profile C standard for networking physical access control this year. Profile C will give systems integrators, specifiers and consultants the ability to deploy an integrated IP-based video and access control solution from a variety of different but compatible video and access control providers.

Cloud also impacted on the access control market, with releases from Salto, Risco and H5Controls that turn access control management into a cloud-based service. Distributed intelligence being what it is, there’s always going to be boots on the ground in the form of door controllers but I think in smaller applications cloud is a perfect fit if secure and if pricing is not too ambitious.

There were a couple of other things. I think the penetration of access control into home automation is interesting for those installers and integrators able to tap into it. Another development in access control in 2013 was biometrics in consumer mobile devices. It’s only early days but maybe this time biometrics will become mainstream…

Despite this talk of change, the most impactful products released in the access control sector in 2013 came from local manufacturers which have been around for a very long time. I’m talking about Inner Range’s Integriti and the locally designed Interlogix Tecom Challenger. Despite their differences, these products are a big deal because they allow many thousands of sites across Australia to move into networked environments while retaining most their existing infrastructure.

Tecom Challenger

Alarm systems

I think the key development in alarm systems in 2013 was remote apps for system management. I think remote apps for alarm systems are going to be an enabling technology. It seems a very small thing but when you can play with your alarm system online, why shouldn’t that system offer multiple functionalities?

Whether these additional functionalities include inputs for environmental monitoring, integrated cameras in sensors, a couple of video inputs on the board; or outputs for automation, air conditioning and lighting; I can’t help thinking that’s the way alarm panels ought to go. It’s the way AT&T is taking its Digital Life security system. Why an industry outsider, a telco, should be the only big company smart enough to understand that alarm salespeople need hooks is beyond me.

AT&T's Digital Life

The other development in alarm systems during the year relates to IP-based alarm reporting. IP comms have been available from folks like AlarmsIP for some years now but why is it still seen as niche? Releases from the likes of Risco and IP alarm reporting pioneer Bosch further cemented IP comms in 2013.I’d like to see every single alarm panel having an RJ-45 port and twin SIM bays for 3/4G in the future. It must happen. Consider the Americans have shelved 2G and we cannot be far behind. Locally, PSTN remains up in the air.

“Tuxedo is a pivotal release. I think price is a thing that needs to be handled with care but the functional direction is right”

Something else I liked in 2013 was cameras integrated into alarm sensors. Honestly, I think the last and even the current generation of alarm sensor cameras are lacking in the performance department. You’re talking QCIF or worse, which isn’t great. I think the first major manufacturer that incorporates quality image sensors will make real headway in video verification.

Obviously there are challenges. Sending images from sensors to panels using current wireless technology is pretty laborious even with still images. Available wireless technologies are capable of handling the task, however. For instance, ZigBee has a set bandwidth of 250Kbps, which is more than enough. Of course, wireless alarm sensors are low power draw so Wi-Fi sensors pushing HD to a switch are out of the question. One answer might be an alarm sensor with a standard low resolution thermal imager. You’d get video verification but no face recognition. But cost would be an issue.

I’ve been moaning about slow development in the alarm industry for a while so it was good to see strong releases from respected makers like Risco and Honeywell. The Risco sensor range is epic and growing but it’s the remote interface and the cloud support of video verification that’s neat in my opinion. The release of DAS’ WireFree range was also good to see.

Products I liked in 2013

What did I think were the best products of 2013? I elected not to narrow it down too finely. There’s a bias obviously, because I don’t get to see everything and there are some technologies I like more than others for personal reasons.

Sony’s Generation 6 camera technology. I think the inevitable success of Sony Gen 6 will make 60ips the new benchmark in CCTV technology. This range of cameras takes low light performance and WDR to new levels. Sony has also worked hard to make Gen 6 affordable.

I liked S2’s gear in 2013. I saw the latest of its controllers at BGWT’s Gold Coast event, recently. S2 combines alarms, access control and video surveillance with storage and browser-based local or remote management. It’s a wonderful solution for SMEs, as well as for bigger applications. The rest of the industry will catch up to S2 one day.

Honeywell Tuxedo. This is a watershed product. I don’t think it’s the only one of Honeywell’s alarm panels that handles automation and I know the company also makes access control boards that incorporate alarm and video inputs but Tuxedo is a pivotal release. I think price is a thing that needs to be handled with care but the functional direction is right.

Honeywell Tuxedo

D-Link’s DCS-2136L day/night camera – the first IP camera with 500Mbps of 802.11ac Wi-Fi support. There’s 1280 x 720p HD (1 megapixel), PIR for enhanced motion detection, 2-way audio with built-in microphone and speaker, microSD Card (SDHC) slot for local storage, Wi-Fi Protected Setup (3-step installation) and H.264, MPEG-4 and Motion JPEG compression. The camera features aren’t earth shattering – it’s that 802.11ac capability that interested to me.

D-Link Wi-Fi HD camera

Salto Clay. It’s a nice product that brings silly amounts of access control functionality to end users wherever they are on planet Earth. It’s affordable. It’s built on layers of proven tech. It’s simple to operate and install. For locksmiths and access control installers familiar with the whole bureau monitoring RMR thing, having a bureau of cloud-based access control sites is going to feel like very familiar territory.

Salto Clay Mobile App

Briefcam Video Synopsis. We’ve collectively installed hundreds of millions of cameras globally but there’s never been a better way to view the events they record than this. Video Synopsis displays a day’s events in a few minutes, overlaying events on screen so you’re seeing a dozen or more at a time. Each event is time-tagged and when you click on it you can watch recorded footage. This is a great solution – one of my favourites of 2013.

HID’s multi-application iClass Seos credentials. Authenticated smart devices as credentials is clever and when smart devices incorporate biometric identifiers this tech will be smarter still.

Flir’s IP66-rated FC-Series S thermal camera. It’s the best affordable thermal camera I’ve seen. There’s excellent ability to handle backlight. The fact the camera gets contrasty images with the sun actually in the field of view, is really something. Resolution is good at 640 x 480.

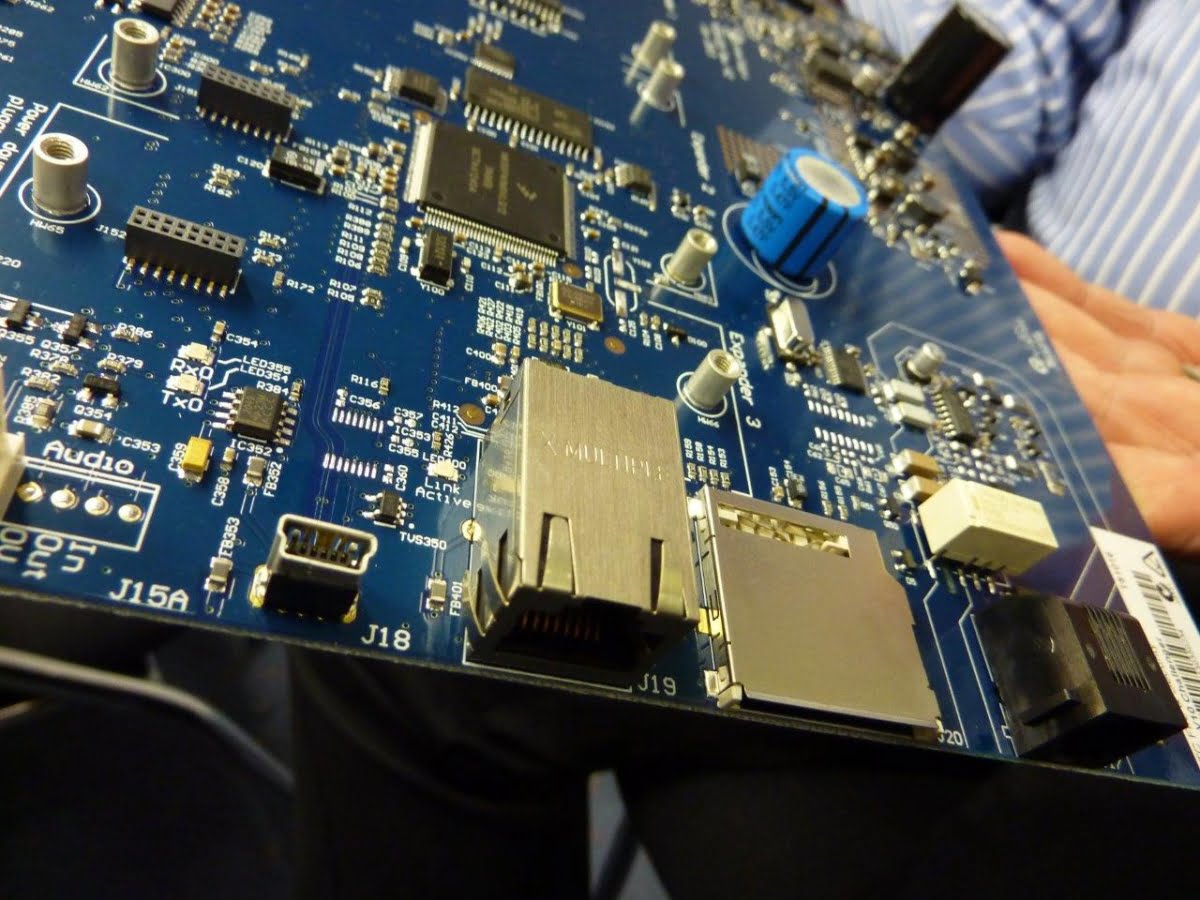

Axis A1001 IP-based access controller, with open architecture for integration of IP video or intrusion detection systems, as well as automatic synchronization and data storage capabilities. It’s PoE, data and config are automatically stored and synchronized between controllers and the units can be managed from any computer in the system.

There’s one controller for each door and a fixed price per door, the whole structure scalable in increments of 1. You get support for most existing reader protocols and reader types. There’s an install wizard and colour coded connectors to make life easier for you installers.

Risco’s axesPlus, a cloud-based access control solution. Also Risco Agility 3 and Lightsys alarm panels and their attended squadrons of sensors. Local wireless. Video verification. High quality sensors in every conceivable category. Cloud management on mobile devices. What’s not to like?

Panasonic’s WV-SW598 1080p PTZ with hydrophilic Rainwash, 30x optical and 90x digital zoom with 0.5 lux in colour mode and 0.06 in monochrome. The camera features Panasonic’s Super Dynamic (WDR), Day/Night capability, and claims 0.5 lux in colour mode and 0.06 in monochrome, as well as a light-shield called Auto Eye-lid Mechanism (AEM) and fog, smoke and sandstorm compensation. This is an impressive camera especially on zoom – it was one of my favourite demos of the year.

Panasonic’s WV-SW598 1080p PTZ with hydrophilic Rainwash

Intruder Alarm or Exterior Deterrent Product of the Year at IFSEC in the UK was Chuango Security Technology’s CG-B11 GSM/SMS touch keypad alarm system. There’s nothing ground breaking about the technology. It’s just a nice, complete intrusion detection system that’s less expensive than everyone else’s gear. Not a local release as far as I know but it’s a statement of intent to look out for.

Genetec’s Synergis Master Controller is a hardware controller that offers distributed intelligence to Genetec access control solutions and integrates with Genetec Security Center 5.2, bringing in video surveillance and all the rest. It supports 64 readers, 512 inputs or 512 outputs, 100,000 cardholders and 150,000 offline events.

DAS Zero Wire. It’s designed to simplify alarm installation in the extreme. The keypad is attractive, there’s a range of sensors, including PIRs, CO2 sensors, smokies and reeds. I’d like to see the range expanded moving forward, so hopefully Hills will continue to invest here.

Global Bionic Optics, developer of the Infinity lens, released its S1080 HD camera through BGWT in 2013. GBO’s S1080 features a huge 1-inch CMOS with the metaphorical sensitivity of Arecibo and circuitry optimised to handle low light while producing very low noise. This camera’s performance in low light is really good. It comes standard with a GBO lens and the cost is oddly sharp. It needs to be tucked up in a quality housing when used outside but it was another favourite of mine.

Global Bionic Optics S1080

FSH’s Eco range include the Ecomag 5700, the V1260 and the FE90MP ecostrike all of which cut lock power consumption by about 5x in access control solutions. FSH has been nipping away at power saving for some years now and this new lineup represents the pinnacle of the company’s efforts to date. On larger sites power savings add up.

Synology’s big NAS range with CMS 6 for video surveillance management. Compatible with all ONVIF cameras, it would be ideal for SMEs with a modest number of cameras. It’s also going to appeal to IT integrators or IT departments looking to find off-the-shelf solutions, as well as to capable home networkers.

H5Controls cloud-based access control. H5Controls has developed web-based solutions to manage and monitor security, safety and energy systems over the net. The idea is that an entire building or facility can be controlled over the internet via any Internet-connected device.

Bosch IP66-rated Starlight HD 720p60 camera family. These cameras are built around a progressive scan CMOS sensor offering 720p resolution (1.4MP or 1312 x 1069 pixels) and a frame rate of 60ips. Bosch is the second manufacturer to head to 60ips (Sony was first), which gives superior performance in fast action scenes. The external version is a very tough customer.

Bosch Starlight

What else? In 2013 I liked Paradox PDX-NV780 external 12m curtain PIR, Aritech’s 5D dual technology sensors, the Mobotix M15 thermal camera and S14 dual-sensor camera, Pacific Communications’ Fluidmesh Fluidity, Interlogix’s Tecom Challenger v10 and BENS’ catchClip HD video verification system.

Mobotix M15

Other nice things this year were IQinVision’s app for Google Glass, Inner Range’s Integriti control panel, Raytec Vario IP and Vivotek’s 8371E bullet camera featuring 3.1MP, P-iris, 60ips, 30m IR and Smart Stream. AT&T’s Digital Life alarm panel. I don’t like what it means for the business but it’s likely to drive our alarm manufacturers to greater efforts, which I think is a good thing.

Which of these do I think is the best new release of 2013? It’s not easy to choose. All of these products have strengths and capabilities that make them admirable. Sony’s new Gen 6 low light is right up there but not quite available in 2013. Briefcam Synopsis was an excellent release, too. When it comes to a product that combines something everyone needs (a physical door lock), with the latest mobile IP technology I can’t go past Salto Clay. In August I wrote that Clay melds hardware and software in a simple and beautiful way. I feel the same way in December.

Salto Clay wireless comms controller

“GBO’s S1080 features a huge 1-inch CMOS with the metaphorical sensitivity of Arecibo and circuitry optimised to handle low light while producing very low noise”

By John Adams