John Adams talks to S2’s R. Todd Smith about the open platform electronic security company’s growth, challenges facing the client-server architecture model and the subtle definition of open architecture.

JA: How is the S2 business going, Todd? We’ve had a pretty tough last 5 years. Are you continuing to experience growth globally in the current market?

RTS: Yes, we are doing very well. We now have a range of very high-profile global accounts in addition to local business we do in the U.S. We manufacture all our products in the U.S. so we can keep control of quality and our IP-based solutions are economical to install and maintain. We are making inroads in Australia, too. We are represented here by BGWT and they have strong sales and support capability and plenty of stock.

JA: What do you put the success of the company down to?

RTS: S2 obviously manufactures cool security technology but the most important thing is to make sure your technology works in real world applications. All our products are tested rigorously on local (beta) customers in the U.S. so our clients are not part of the development process. Right now we’re on the third generation of IP-centric product.

JA: S2 is a disruptive manufacturer in the electronic security space. What makes you so different?

RTS: I think the way we are different from everyone else is that we have invested in a different type of technology than many of the traditional manufacturers. If you look at the products out in the field, most of the underlying technology was designed in the 1990s and some of these companies have not re-invested. They have not done what they needed to do to stay ahead in business solutions.

Something else that’s important is that security is not just about security any more, it’s about an overall solution. Our technology offers this overall control of sub systems. It’s also designed to be browser-based, to operate on the fly, to be easy to manage technically and to be much less expensive to purchase and install, which is more and more important.

What proves the strength of S2’s technology is its market performance. Through very tough economic times we have continued to sell our products and increase our sales. That’s because we are stealing market share. I think the overall electronic security market grows at 5-6 per cent in most areas and if you are growing faster than this – between 10-20 per cent as we are – then you are taking business away from the other guys. We are definitely taking market share from traditional access control manufacturers whose products are based on old, proprietary technology.

JA: Are you saying that the traditional access control and traditional IT models are being irrevocably eroded?

RTS: That’s what the evidence shows. When you look at traditional players like Microsoft which develops software for PCs and server applications, their share of the market is waning. This flagging performance shows that Microsoft-based products are on their way out. Supporting this was news last month that Microsoft is laying off 20 per cent of its work force – taking contractors into account the figure may be closer to 30 per cent.

This is very bad news for electronic security products that are shackled to the Microsoft operating system which resides on servers and PCs, and links to controllers using serial RS-232 and RS-485 that was invented at Bell Labs way back in 1968. That whole model is not the latest technology. What we are talking about is obsolescence risk. The traditional and expensive Microsoft-based solutions are outdated and tired, and customers are becoming more sensitive to that.

JA: How are S2’s systems different?

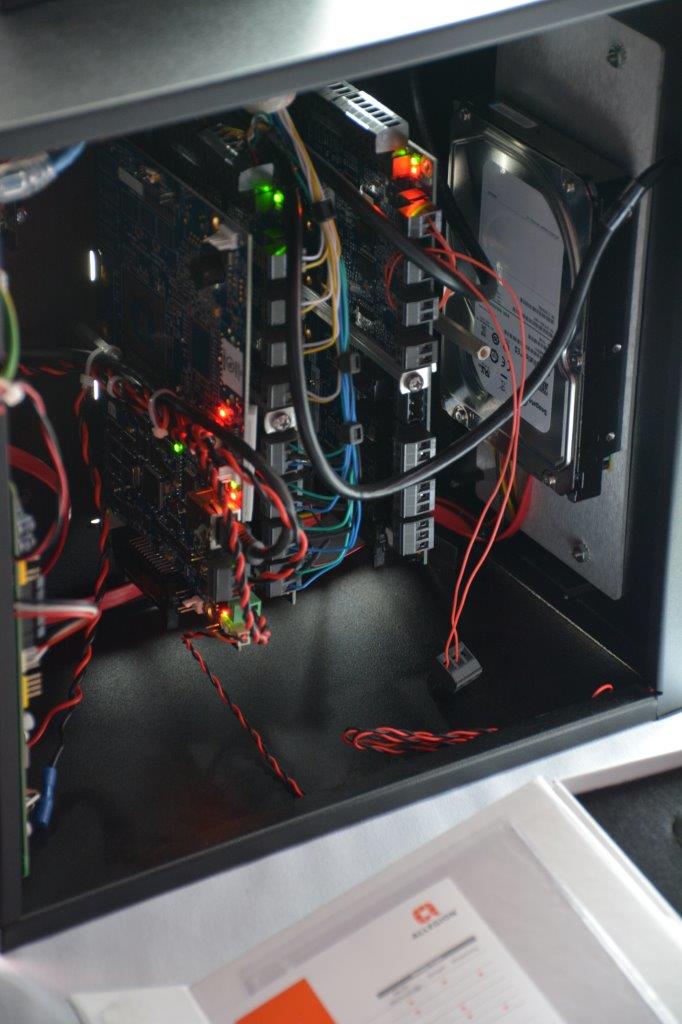

RTS: Our solutions are completely different in that controllers have embedded servers running Linux and you browse into them via any internet link. There are not multiple layers of on-site software and hardware required. We chose to go browser-based because everyone can use a browser and also because browsers are more secure than client application because they don’t store any data. You often hear of PCs being hacked but that can’t happen with a browser-based system.

The design of our solutions makes them endlessly expandable vertically and laterally. And along with our security management system platform and video management system platform we have global mobility applications that link multiple systems, anywhere. This makes our solutions very powerful. For instance, NetVR couples alarm management, access control and intrusion alarms, and you can type in a person’s name and call up all the video related to access events involving that person across a global solution. It’s very simple.

You can scale up to global systems that bring all the alarms, events, video from multiple independent systems wherever you happen to be. It means you can see all the cameras, alarm and access events and handle emergency mustering using a wireless mobile device you pull out of your pocket. And it’s plug and play architecture so it snaps together – you don’t have pay us hundreds of thousands of dollars to build it for you.

JA: It’s true the electronic security people can be slow to change. Do you think the security industry is changing now?

RTS: We think there’s greater change going on in the security industry than at any time in the last 20 years and that change is accelerating. There are really big and shocking types of changes taking place. When I say shocking changes what I mean is the sort of changes that impact on suppliers, installers and end users when manufacturers disappear. We have seen that in the video surveillance market with the transition from analogue to digital. Some companies failed to successfully make the transition, or having partially made the transition, they failed to keep developing their solutions.

Q: What do you think is the most important consideration for suppliers and installers of security technology who want to stay on top in the current market?

RTS: Recognising that end users want to do things differently today, they want different types of services and they want to interact with systems differently. The people who supply technology and services have to be able to keep up. We see companies who are failing to keep up, whose service levels start declining, and whose relationships start failing.

JA: What is the mistake such manufacturers are making, in your opinion?

RTS: Their technology remains proprietary even when they say it is not and that’s expensive for customers. It’s such a fundamental thing. We won a banking job recently where it would have cost almost the same amount just to replace the existing system’s old servers as it cost to completely switch over to S2. The customer said, “So, for an extra $US20,000 we can have a brand new S2 system? Give us the new system, please”.

In comparison to the proprietary model, S2 can use its own or multiple vendors’ access control hardware on the same network and on the same system. S2 also has the ability to go in and use the existing hardware – locks, readers, sensors, cameras. And we have free architecture tools you can use to put together third party applications – there are very few products that we don’t integrate with. We are doing this right now on a 4000-reader reader system in the U.S. and this will happen more and more often with the systems of traditional manufacturers.

This is what open platform is. Everybody talks open platform, every manufacturer says “we’re open platform”. Really? What they really means is that they have software development kits that allow integrators to tie software together but not hardware. If you can’t work with a manufacturer’s hardware in an open environment then the system is not open.

Locking clients into a proprietary environment is old school, it’s not the way this business works anymore. End users want seamless, affordable integration. We see the big traditional brands as not leading the market today. Instead it is smaller companies focused on investing in technology, service and relationships we see winning the race.

R. Todd Smith with John Adams