SMART Home systems, incorporating automation and security functionalities are continuing to grow at furious speed, with interest from big IT and technology players, as well as the insurance industry, adding heat to a sector already on fire. And the word on the street is that traditional alarm panels are running out of time.

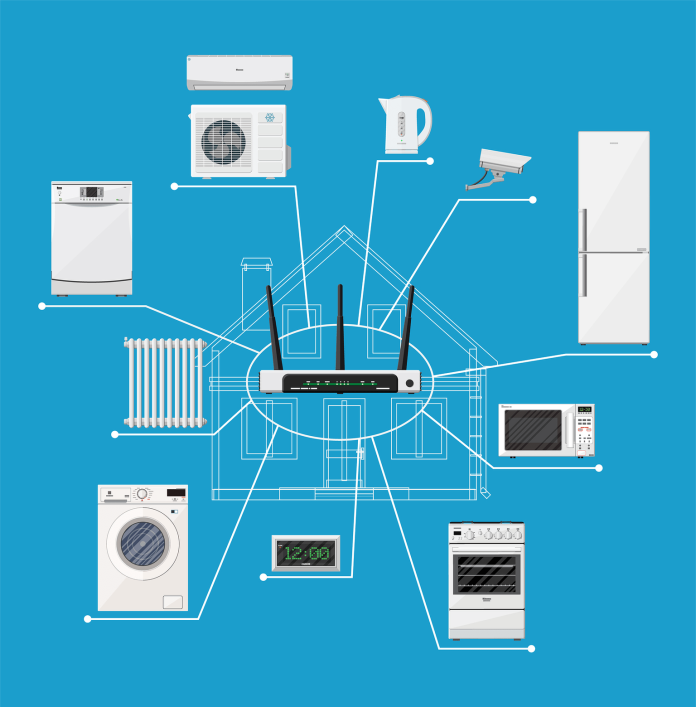

THERE was a lot of talk at SecTech Roadshow about the future of alarm monitoring. Would the traditional alarm panel die out? Yes, was the reply. It’s going to be taken over by home automation, by smart homes, by cloud-based solutions, by direct-connect devices management by smart phones. It’s over for alarm panels and hard-wired security devices, the beating heart of the modern security system is a router.

But exactly how traditional security will die and what exactly will replace it remains in doubt. It’s partly because whatever comes after the traditional alarm panel is not going to be anything like the traditional alarm panel – not just in terms of potential functionality, but in terms of the business model that drives it. Installers and end users are going to shift from closed notions of monitoring to open ecosystems that are devoid of lateral constraint.

Does this imply mean the end of alarm monitoring as we know it? Well, no, actually. It implies that for those installers and central stations willing to embrace change, it’s the beginning of the monitoring of everything. Of course, there’s a caveat. Serious players keep circling the security and home automation market looking for a way in. All the usual suspects are out there – Apple, Amazon and Google. Then there are insurance companies who say smart homes will allow them to tailor policy recommendations, while neglecting to say that such systems will help them reduce risk and even manage risk in real time.

On all sides, investment in the sector is growing apace. According to Juniper Research, what the company describes as open ecosystems will continue to accelerate in growth reaching 1 billion automation and monitoring devices within 5 years up from just 176 million today. What’s the driving force behind this growth? Funnily enough it’s more capable security solutions, as well as organisations like Google with Nest, Hive, Alexa, Netgear and Amazon, which continue to seek a solution which will breach the mass market.

Amazon, whose owner Jeff Bezos recently announced he wanted to colonise the moon, recently purchased Ring, a company which makes networked and remotely accessible video doorbells, cameras and other domestic automation gear. Without saying much, Amazon has also completed and launched a home security services portal which is selling all the equipment users need to build their own security solution – as well as visits from Amazon consultants to advise and install gear.

The packages are being sold in 5 price tiers, at a flat fee — no monthly service contracts. Least expensive is $US240 for Outdoor Base, which includes an Echo Dot (hands-free voice controller) plus indoor and outdoor lighting, while the most expensive tier is Smartest, which for $US840 includes an alarm siren, motion sensors, sensors, a camera, an Echo Dot, lighting and a video doorbell. Nothing about this is spectacular – nothing but the provider, that is.

Stoking things up further still, Juniper Research argues that during 2018, roughly 65 million new home insurance policies will leverage smart home technologies. In fact, many insurance companies seem to view home automation as a serious opportunity for business expansion/risk reduction and are offering discounts to customers who have Nest smoke and CO2 alarms, with additional discounts for flood sensors and monitored solutions.

Something else that’s interesting is a push to use smart home technology to confirm events that lead to a claim to process claims faster. And some insurance companies are even considering tapping into smart devices to inform customers when a device records an issue that might lead to a claim – the activation of a flood sensor, or the change of temperature in a commercial freezer, for instance. Further, insurers are interested in using data from smart home systems to tailor policy recommendations for an individual customer.

Are Australian installers interested in security and home automation technology? If what we saw at SecTech was anything to go by, they certainly are. There’s was plenty of interest in the Risco gear on the VSP stand. CSM, which probably carries the widest range of security and automation brands, also got of attention at SecTech. Although not released at SecTech, we got a run-through of SCSI’s new Almond 3s security and automation solution – it’s a thoughtful release – a telecommunications solution with a security soul.

There seems to be a confluence of functionality and cost that’s flowing through the security and home automation sector. Routes to market are maturing a little, technology is seen and reliable and most importantly, end users are open to smarter home solutions. The Australian security and home automation sector was recently valued at $US887 million annually – that’s a considerable sum, despite the fact penetration across both sectors remains slight.